Section 44AA

Compulsory Maintenance Of Books Of Accounts Under Income Tax

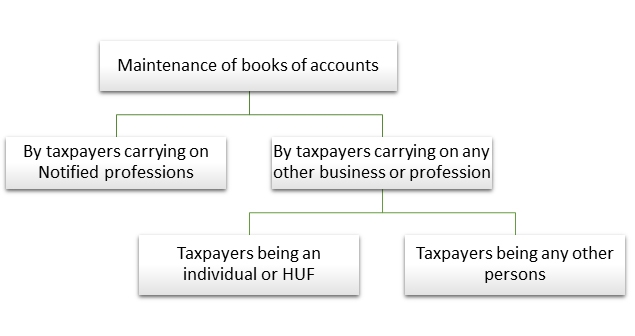

Section 44AA of the Income Tax Act, 2017 requires certain classes of taxpayers to mandatorily maintain books of accounts.

Maintenance Of Accounts Under Section 44AA:

Maintenance Of Books Of Accounts By Taxpayers Carrying Out Notified Professions

Governing law: Rule 6F of the Income Tax Rules, 1962 read with section 44AA of the Income Tax Act, 1961

What Are The Notified Professions As Per Section 44AA?

Every person carrying out the following professions are required by law to maintain books of accounts and other documents as required

- Legal

- Medical

- Architect

- Engineering

- Accountancy

- Technical consultancy

- Interior decoration

- Authorized representative

- Film artist

- Company secretary

- IT professional

- Any other profession as maybe by the board

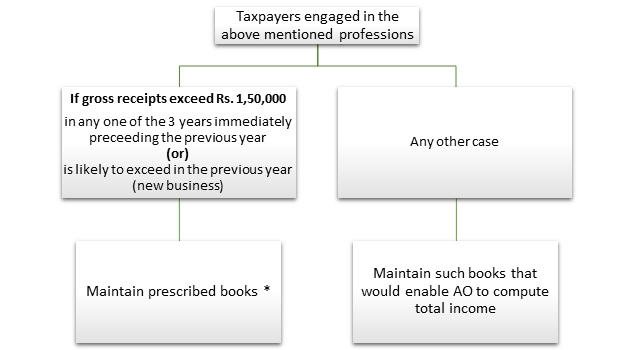

Maintenance Of Books Of Accounts In Case Of A Freelancer Pursuing Any Of The Above Notified Professions?

A freelancer pursuing any of the above mentioned professions with gross receipts exceeding Rs. 1,50,000 should maintain books of accounts.

Who Is An Authorized Representative?

Authorized representative means an individual who represents another person in exchange for a fee before any authority under the law.

Threshold Limit:

What Are The Prescribed Books?

- Cashbook

- Journal, if the accounts are maintained according to the mercantile system of accounting

- Ledger

- Carbon copies of bills exceeding Rs. 25/-

- Original bills in case the expenditure exceeds Rs. 50/-

- A daily case register in Form No 3C (applicable only for a person carrying out medical profession).

- An inventory/stock register as on first and the last day of the previous year, of drugs, medicines, and other consumable accessories used for the purpose of his profession. (applicable only for a person carrying out medical profession).

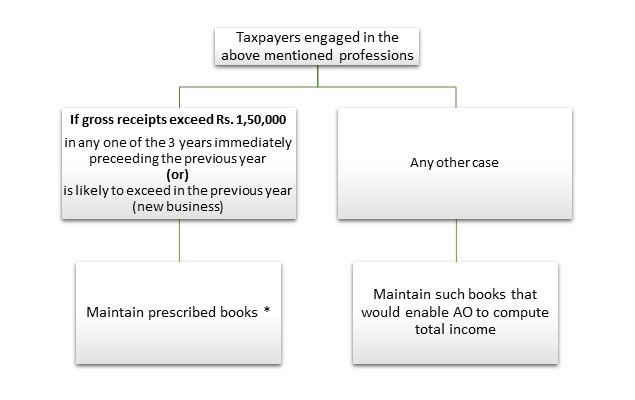

Maintenance Of Books Of Accounts By Taxpayers Carrying On Any Other Business Or Profession Other Than Notified Professions

Threshold Limit:

Important FAQ’s Relating To Section 44AA

Where Should Such Books Of Accounts Be Maintained?

- These books of accounts should be maintained at the Head Office or at the place at which such profession is being carried on.

- If the profession is carried out in multiple places, the books shall be maintained in the principle place of profession.

How Many Years Should The Books And Accounts Be Maintained?

- The books must be maintained for a period of 6 years from the end of the relevant assessment year.

- Where assessment under section 147 is reopened for any of the previous year, all the book of accounts which were kept and maintained at the time of reopening of the assessment shall continue to be so kept and maintained till such assessment is complete.

What Is The Penalty For Failure To Maintain Records As Per Sec 44AA?

- Failure to maintain records can attract a penalty of up to Rs. 25,000.

- In case of international transactions, the same would lead to a penalty of 2% of the value of international transactions.

Are The Taxpayers Opting To Pay Tax On Presumptive Income Maintain Books Of Accounts Under Section 44AA?

Presumptive taxation under section,

- 44AD – not required to maintain books under section 44AA:

However, if the assessee switches to normal scheme from presumptive taxation and if income exceeds basic exemption limit of Rs. 2,50,000 – taxpayer is required to maintain books of accounts. - 44ADA – not required to maintain books under section 44AAHowever, if the assessee switches to normal scheme from presumptive taxation and if income exceeds basic exemption limit of Rs. 2,50,000 – taxpayer is required to maintain books of accounts.

- 44AE –

required to maintain if the assessee has claimed his income to be lower than the profits or gains to be calculated as per the provisions of section 44AE