Classification Of Capital Assets

For the purpose of taxation, assets are classified into short term and long term assets.

How To Determine Whether An Asset Is Long Term Or Short Term?

| Particulars | Amount |

|---|---|

| Full value of consideration | XXX |

| Less: Transfer Expenses | XXX |

| Net Sale Consideration | XXX |

| Less: Indexed Cost of Acquisition* | XXX |

| Less: Indexed Cost of Improvement* | XXX |

| Short term Capital Gain / Long Term Capital Gain | XXX |

*Benefit of indexation is available only in case of long term capital assets.

What Is Indexation?

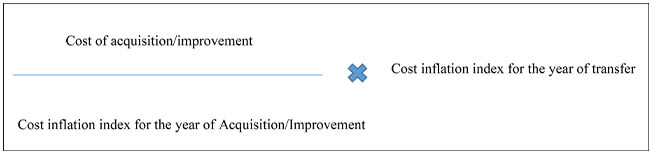

Indexation is a process by which the cost of acquisition is adjusted against inflationary rise in the value of asset.

How The Benefit Of Indexation Is Made Available To The Assessee?

Note:

For assets acquired before PY 2001-2002 the cost inflation index for the year of acquisition is 100

Benefit Of Indexation Is Not Available In The Following Cases:

- Shares and securities, units of equity oriented fund and units of business trust

- Bonds or debentures other than,

- Capital indexed bonds (issued by the Government)

- Sovereign Gold Bond (issued by RBI under the Sovereign Gold Bond Scheme, 2015)

- Depreciable capital asset (other than an asset used by a power generating unit which is depreciated under SLM).

- Slump sale

- GDR (Global depository receipts).