Associated Enterprises

What Do You Mean By Associated Enterprise?

In simpler terms, associated enterprises are enterprises which directly or indirectly control another enterprise. Control can be exercised through various means such as, equity investment, participating in the management, control of board of directors, providing loans/guarantees etc.

As per section 92A of the Income tax act, 1961, associated enterprises can be classified under the below mentioned broad categories.

- Associated enterprises by,

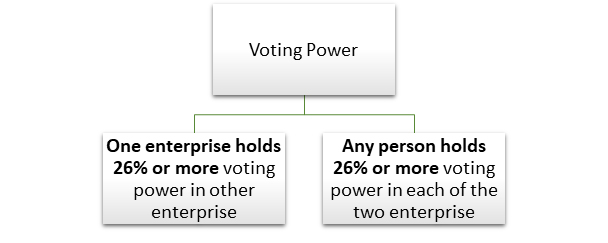

- Virtue of Voting Power

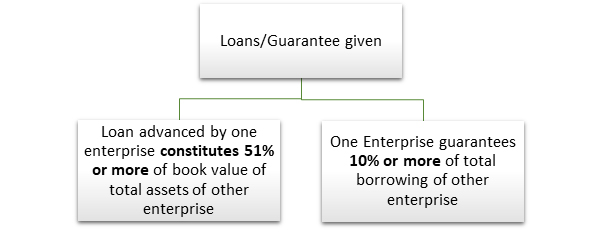

- Virtue of loans/guarantees given

- Virtue of appointment of Board of Directors

- Virtue of dependence for carrying out business operations

- Virtue of Control

- Virtue of being a profit sharing partner

- Virtue of any other type of Mutual Interest

I. By Virtue Of Voting Power

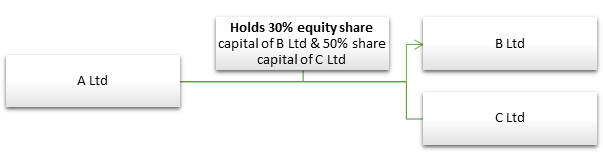

Example 1:

- A Ltd and B Ltd are associated enterprises – by virtue of A Ltd holding more than 26% voting power (by way of owning equity share capital) in B Ltd.

Example 2:

- A Ltd and B Ltd are associated enterprises – by virtue of A Ltd holding more than 26% voting power (by way of owning equity share capital) in B Ltd.

- A Ltd and C Ltd are associated enterprises – by virtue of A Ltd holding more than 26% voting power (by way of owning equity share capital) in C Ltd.

- B Ltd and C Ltd are associated enterprises – by virtue of A Ltd holding more than 26% voting power in both B Ltd and C Ltd.

Note: Preference share capital should not be considered since the holders of preference shares do not have any voting rights.

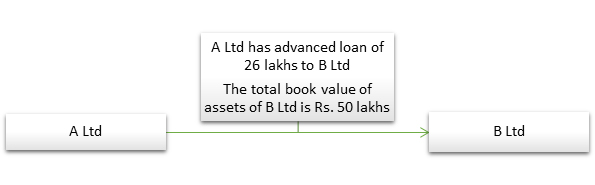

II. By Virtue Of Loans/Guarantees Given

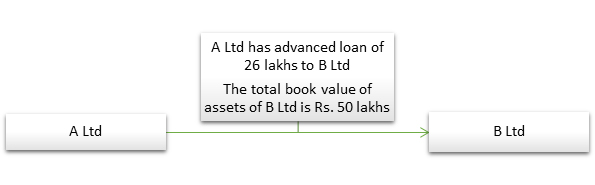

Example 3:

- A Ltd and B Ltd are associated enterprises – by virtue of A Ltd advancing loan of Rs 26 lakhs to B ltd in excess of 51% of book value of assets of B Ltd (50 lakhs * 50% = 25 lakhs)

Example 4:

- A Ltd and B Ltd are associated enterprises – by virtue of A Ltd providing guarantee of Rs. 6 Lakhs which in excess of 10% of the total borrowings of B Ltd (50 lakhs * 10% = 5 lakhs)

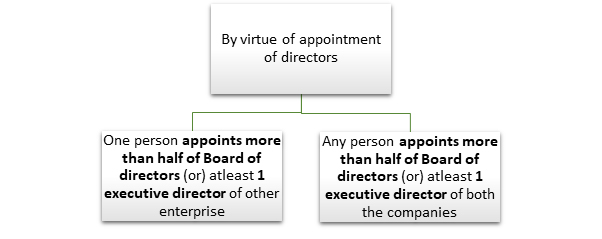

III. By Virtue Of Appointment Of Board Of Directors

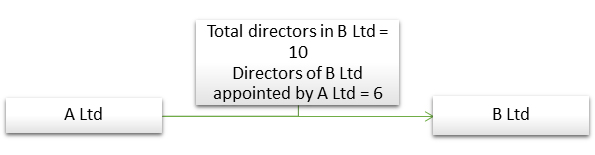

Example 5:

- A Ltd and B Ltd are associated enterprises – by virtue of A Ltd appointing more than half of the board of directors of B ltd.

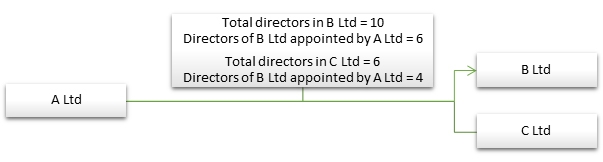

Example 6:

- A Ltd and B Ltd are associated enterprises – by virtue of A Ltd appointing more than half of the board of directors of B Ltd.

- A Ltd and C Ltd are associated enterprises – by virtue of A Ltd appointing more than half of the board of directors of C Ltd.

- B Ltd and C Ltd are associated enterprises – by virtue of A Ltd appointing more than half of the board of directors of B and C Ltd.

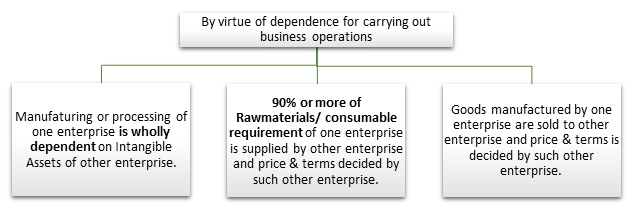

IV. By Virtue Of Dependence For Carrying Out Business Operations:

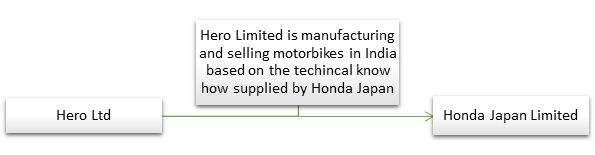

Example 7:

- Hero Ltd and Honda Japan Ltd are associated enterprises – by virtue of Hero Ltd depending on Honda Japan Ltd for technical know how relating to manufacture of motorbikes, without which hero cannot manufacture bikes.

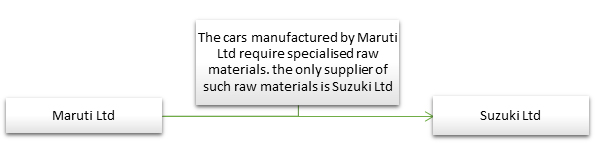

Example 8:

- Maruti Ltd and Suzuki Ltd are associated enterprises – by virtue of Maruti Ltd depending on Suzuki Ltd for 90% or more of its raw material requirement.

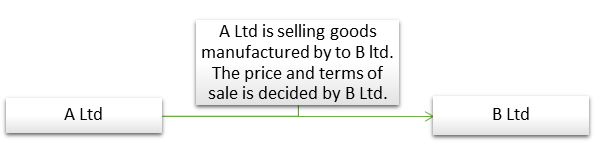

Example 9:

- A Ltd and B Ltd are associated enterprises – by virtue of B Ltd having control over the sale transaction over goods manufactured by A Ltd.

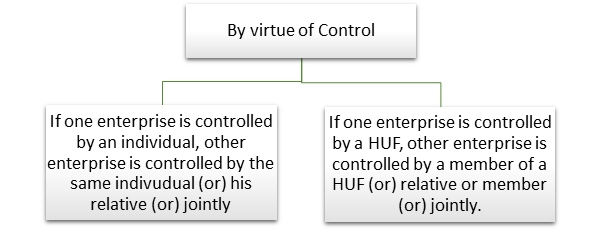

V. By Virtue Of Control

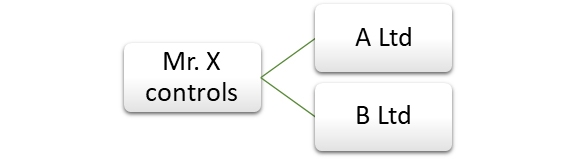

Example 10:

- A Ltd and B Ltd are associated enterprises – by virtue of Mr. X having control over A & B Ltd.

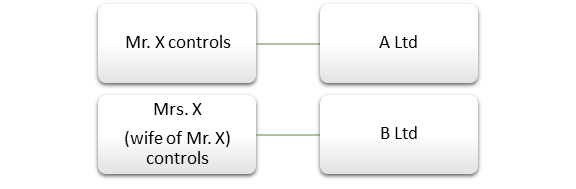

Example 11:

- A Ltd and B Ltd are associated enterprises – by virtue of Mr. X and his spouse controlling A and B Ltd respectively.

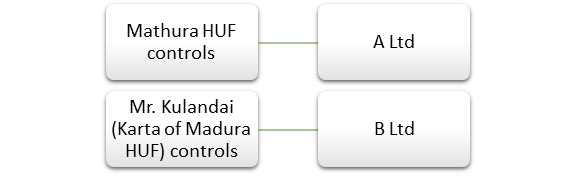

Example 12:

- A Ltd and B Ltd are associated enterprises – by virtue of the HUF and a member of the HUF controlling A and B Ltd respectively.

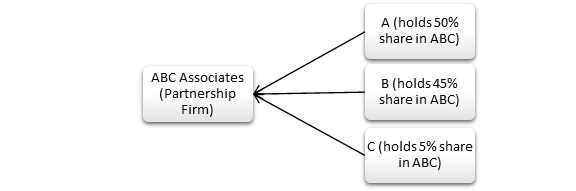

VI. By Virtue Of Being A Profit Sharing Partner

- If one enterprise is a Firm/AOP/BOI, the other enterprise holds atleast 10% share in profit or loss in such enterprise.

Example 13:

- ABC associates and A Ltd are associated enterprises – by virtue of A holding more than 10% profit/loss share in ABC Associates.

- ABC associates and B Ltd are associated enterprises – by virtue of B holding more than 10% profit/loss share in ABC Associates.

- ABC associates and C Ltd are NOT associated enterprises – since C holds less than 10% profit/loss share in ABC Associates.

VII. By Virtue Of Any Other Type Of Mutual Interest

- There exists any relationship of mutual interest between two enterprises.

- For eg. if A and B Ltd enter into a joint venture, both A and B ltd are deemed to be associated enterprises.