Overview :

What Is Time Of Supply?

The liability to pay tax on goods, shall arise at the time of supply, as determined using the following provisions,

Note:

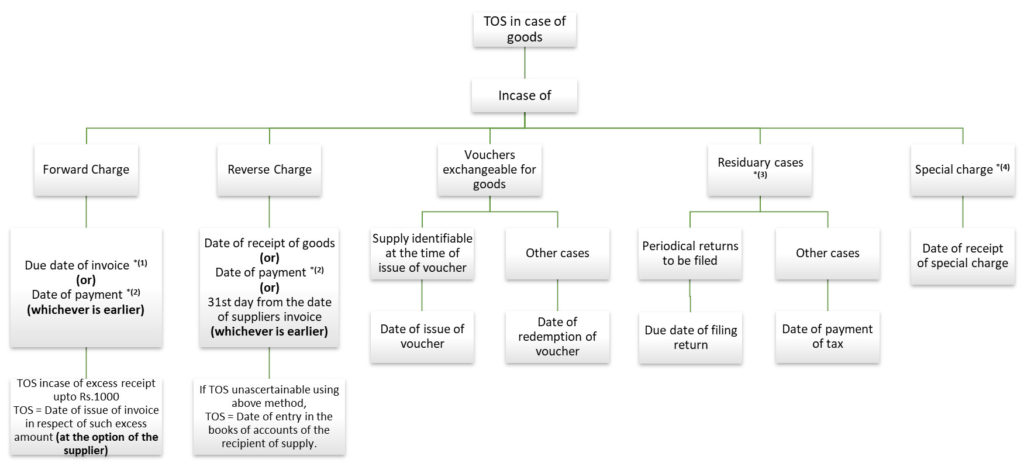

Where the supplier receives an amount upto Rs. 1000 in excess of the invoice amount, the supplier has an option to consider the time of supply of such excess amount as the date of issue of invoice in respect of such excess amount.

Time Of Supply Of Goods

- Due date of invoice = last day on which the supplier is required to issue invoice under Section 31 of the CGST Act, 2017.

- Date of receipt of payment = Date on which the payment is entered in the books of accounts of the supplier (or) date on which payment is credited to bank account of supplier (whichever is earlier).

- Residuary cases = cases where supply does not fall under forward charge, reverse charge, vouchers exchangeable for goods.

- Special charge addition in value of supply by way of to the shall mean interest, penalty, penalty

Time Of Supply Of Services

- The time of supply of services is similar to time of supply of goods as mentioned in the chart above, except for the TOS in case of reverse charge,

- TOS in case of reverse charge = Date of payment (or) 61st day from the date of suppliers invoice (whichever is earlier)

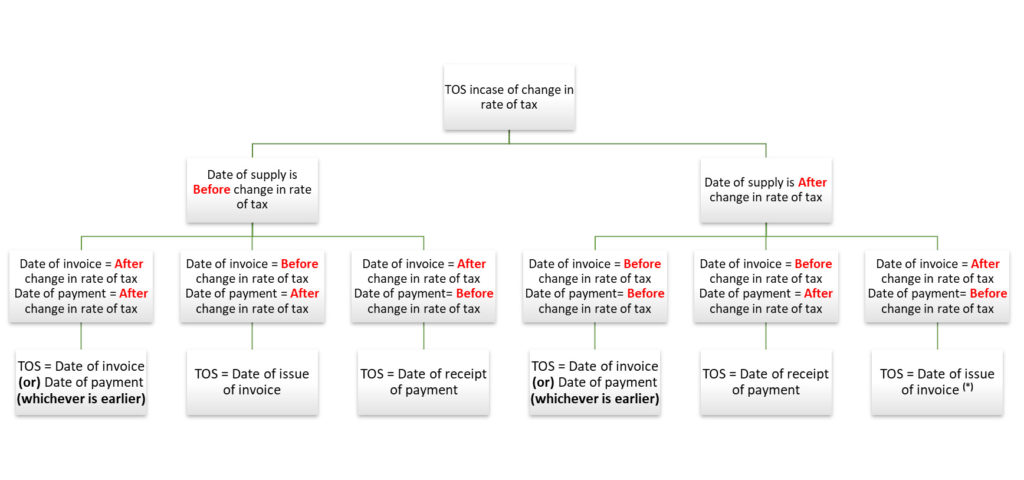

Time Of Supply In Case Of Change In Rate Of Tax

Provided that the date of receipt of payment shall be the date of credit in the bank account if such credit in the bank account is after four working days from the date of change in the rate of tax.